As the current rate cycle appears to be reaching its peak, investors are seeking out opportunities combining attractive income returns with the prospect of outsize capital growth through yield compression. The accommodation hotel market has emerged as a standout candidate, as the sector’s resilient performance continues to gain momentum in 2024.

Despite positive trading, many hotel owners are suffering under the weight of overburdened capital structures with assets coming to market at pricing not available since the period following the global financial crisis. Combined with a positive outlook for demand and the prospect of limited new hotel development due to significant increases in the cost of construction and development finance, Australian accommodation hotels are a compelling buying opportunity.

What are the structural and cyclical trends impacting the Australian accommodation hotel market, how robust are the long-term market fundamentals driving the sector and where do we see the unique investment opportunities emerging?

Compelling market fundamentals

Australia is a leading global travel destination with a mature and deep accommodation hotel investment market. The performance of Australia’s urban hotels has shown resilience as demand from a diversified mix of leisure, business, group, and international travel continues to strengthen from the forced shutdown lows of 2020.

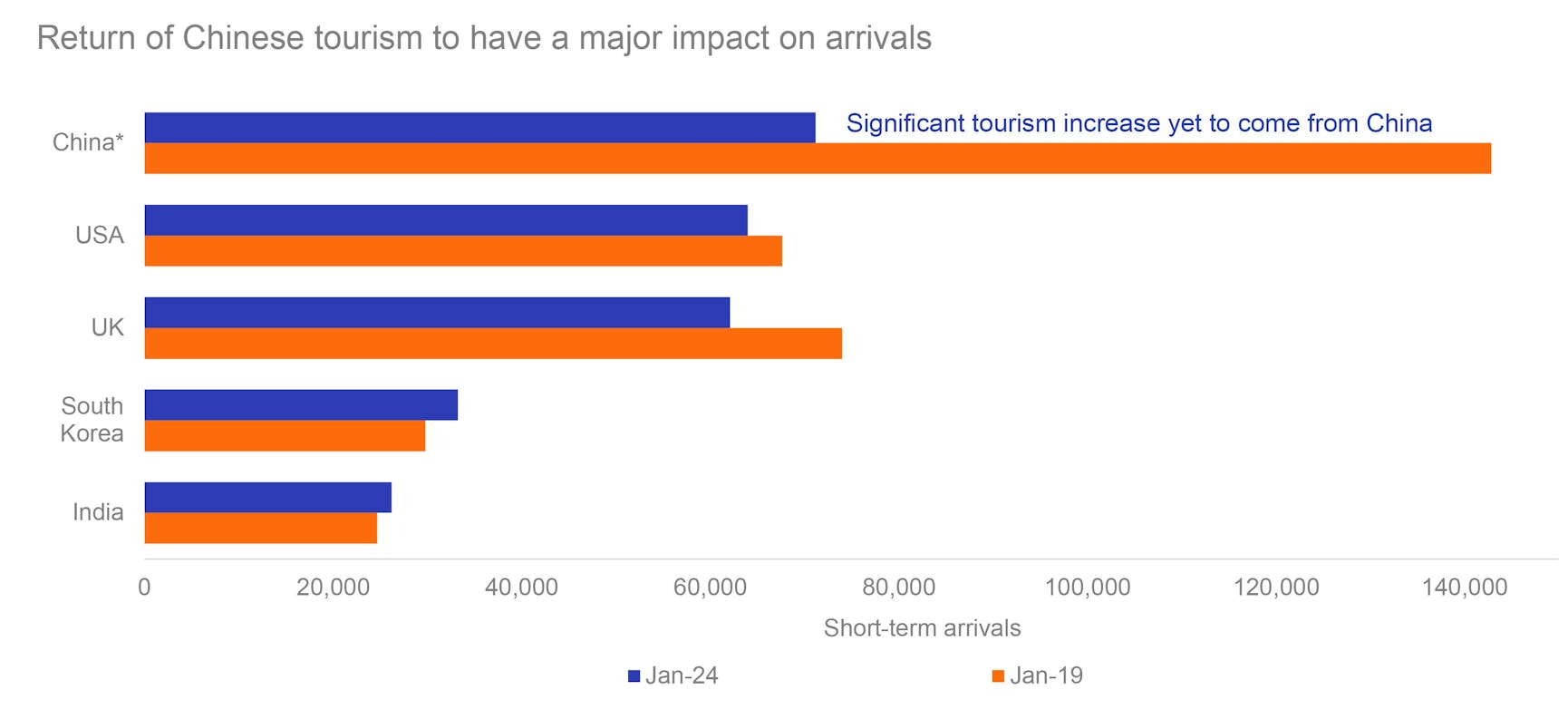

As outlined in our earlier insight Investing in Australia’s accommodation hotels, the accommodation hotel sector has proven resilient in terms of occupancy and revenue growth. Occupancy for Australia is approaching pre-COVID levels despite international short-term visitor arrivals only recovering to ~80% of pre-COVID volumes.1 There is significant upside for occupancy levels to recover further as international tourism continues to strengthen and the return of the Chinese inbound market gains momentum.

Strengthening demand from international and domestic channels has supported market fundamentals across the tourism sector. Latent demand from stringent travel limitations, the removal of restrictions on outbound Chinese tourism, increasing airline capacity, the opening of new international routes connecting Australia to major global destinations, combined with elevated domestic household savings and strong labour market continue to drive improving revenue performance across accommodation hotels.

At the same time as demand diversifies and deepens, the supply cycle has peaked.

New supply is likely to be constrained over the medium term as developers face numerous obstacles including the increased cost of capital, double digit year-on-year increases in construction costs, and extended development timelines (due to pandemic labour and material shortages). These considerable hurdles coinciding with declining asset values has pushed the price of many assets well below replacement cost.

Inward bound | Australia's tourism resurgence

The number of short-term international arrivals to Australia remains firmly on the path of returning to pre-pandemic annual trend levels, surging to 7.4 million visitors over the year to January 2024.2 Boosted by the remarkable resilience of global economic growth, the recovery of international business travel capacity and return of in-person meetings, conferences and events has supported increasing tourist arrival numbers.

Tourism Research Australia estimate a further 25% increase in short-term international arrivals can be achieved over 2024 forecasting 9.3 million arrivals for the full year. By 2025 international tourists arriving in Australia should surpass pre-pandemic levels to set a record annual level of 10.2 million and reach a staggering 12.1 million by 2028.3

There are several factors driving the positive outlook for international visitors to Australia.

- The continuing increase in Chinese visitation. Prior to the pandemic, China was Australia’s largest inbound market (marginally ahead of New Zealand). It is just over a year since the Chinese border reopened and inbound arrivals are hovering at 50% of pre-pandemic levels.4 The increase in the number of tourists from China in 2024/25 is expected to be substantially larger than for any other individual source market, forecasting to surge to ~1.9 million visitors by 2028 (one in six international arrivals to Australia).5

- Increased aviation capacity via the re-opening of flight routes and commencement of new international routes into and out of Australia. The opening of the new (curfew-free) Western Sydney International Airport in 2026 will significantly expand Sydney’s international aviation capacity.6

- The return of in-person meetings, corporate events, and conferences as well as the recovery in international air capacity. Australia ranks in the top 15 markets for business travel with business travel spending increasing 27% year-on-year in 2023.7

- Strong ties to high-growth markets in Asia-Pacific. India, Vietnam, Thailand, and the Philippines have been Australia’s tourism source markets to undergo the fastest recovery. Arrivals from India are forecast to continue to increase strongly reflecting the country’s powerful economic momentum, and extensive Indian diaspora in Australia.8

Source: Australian Bureau of Statistics, Overseas arrivals and departures, Australia, www.abs.gov.au. Top five source countries based on month ending January 2024 (excluding New Zealand)

*Excludes SARS and Taiwan

Domestic demand drivers run deep

The resurgence in international visitors combined with a strengthening domestic tourism market has underpinned the performance of Australia’s accommodation hotels. Despite cost-of-living pressures, the latest National Visitor Survey reports the number of domestic overnight trips is up 5% year-on-year and the level of overnight spend has increased significantly (21%) compared to the same period in 2022.9

At ~50% of the Australian economy, domestic household spending is an important indicator for the macro-outlook. Spending on recreation (including hotels, package tours, airlines, airports and tour operators) has remained positive in early 2024, despite inflationary pressure and rapid rise in interest rates.10 The growth in spending is cause for optimism for continuing healthy domestic demand for accommodation hotel and related tourism services.

Sydney and Melbourne | International gateways to Australia

Sydney and Melbourne, Australia’s major gateway cities, benefit from a diverse mix of international, corporate and leisure demand drivers. Two-thirds of Australia’s short-term international travellers choose to spend most of their time in NSW and Victoria with a further 18% of all visitors predominantly visiting Queensland.

Not only the major gateways to access Australia’s regional tourist destinations, Sydney and Melbourne are the hub of Australian corporate and cultural life, hosting major international sporting events, attractions, and conferences catering to a wide spectrum of visitors.

Accommodation hotel assets in Sydney and Melbourne CBDs and surrounding inner suburbs are tightly held and keenly sought by investors due to the depth of the market, strong and diversified demand profile, robust revenue, and resilient capital growth performance through numerous cycles.

Attractive point in the cycle for acquisitions

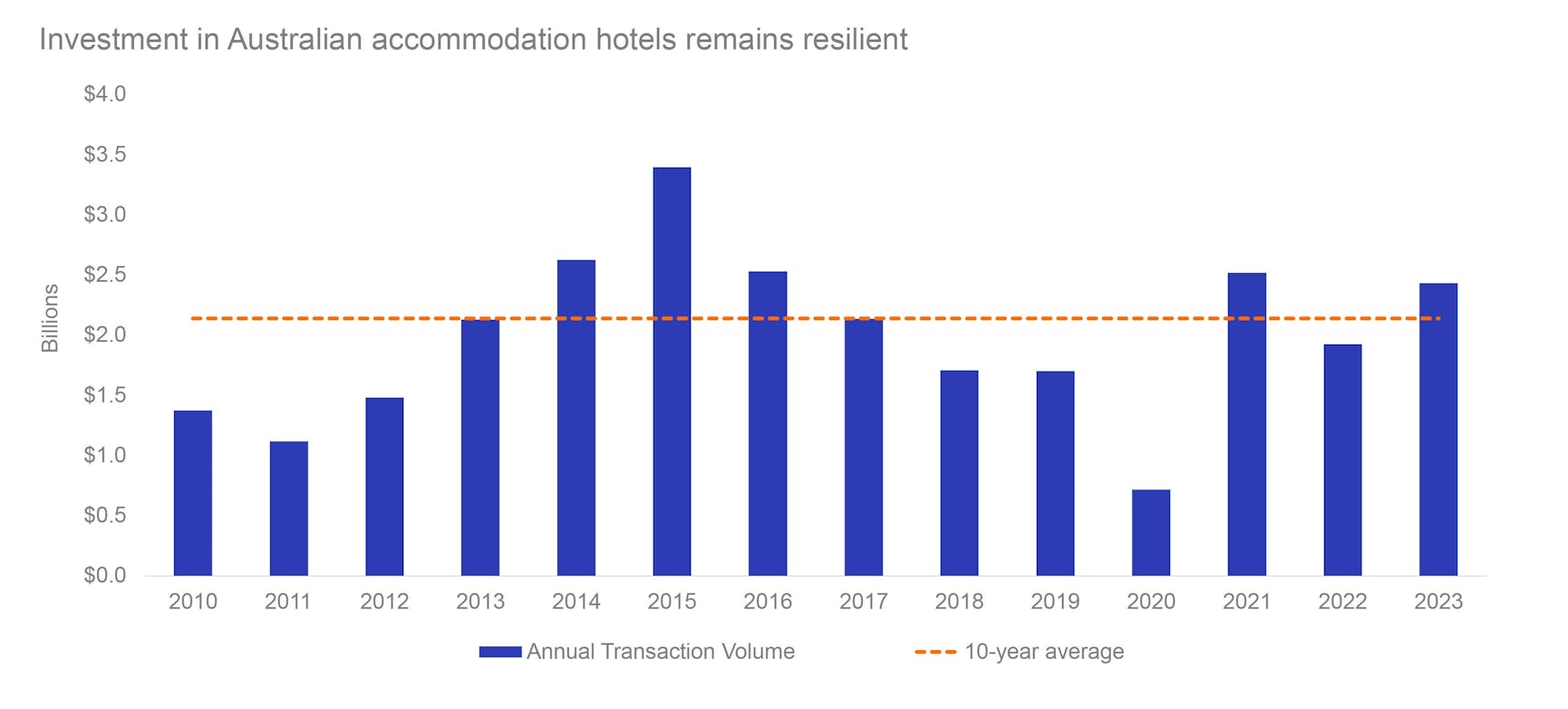

Despite capital market dislocation, elevated cost of debt and investment yield expansion, Australian hotel investment volumes picked up over 2023, an increase on the previous year and above the 10-year long term average.11 Deal volume was heavily weighted to the three Australian eastern seaboard states, representing just under three quarters of overall volume.

Several large trophy deals and portfolio sales boosted investment activity (the top ten transactions accounting for ~70% of the total) and 73% of overall annual sales were concluded in the first half of 2023, driven by optimism around a continued strong trading recovery and positive investor sentiment for the tourism sector.

Source: JLL Hotels & Hospitality Group, Australian accommodation hotel transaction volumes (>$5 million)

Surging interest rates driving investment yields higher and asset valuations lower has created immense pressure on capital structures (for some owners) who acquired and funded assets at very low rates and now have limited access to new equity. The concentration of Australian hotels in private ownership means many owners of newly-completed assets are not well positioned to deal with these challenges.

While the tourism sector resolutely regroups from the disruption of closed international and domestic borders over 2020/22, several forces have shifted in tandem to create niche opportunities for astute investors to secure accommodation hotels located on prime CBD real estate at attractive stabilised yields and significant discount to replacement cost. Importantly, assets available with vacant possession enable a new owner to achieve immediate scale and further operational upside through hotel operator replacement or restructuring of operator terms.

We anticipate renewed investor interest in accommodation hotels over 2024/25 as an increase in quality, mid-scale assets in major CBD locations comes to market.

Emerging opportunities | Capitalising on Australia’s tourism boom

Australia is brimming with pristine and exceptional tourist destinations. The medium-term outlook for occupancy and revenue growth in Australia’s accommodation hotel market looks bright driven by improving and diverse demand drivers from both international and domestic channels and a significantly lower supply of new rooms.

Increasing revenue coinciding with cyclically low asset pricing has created exceptional opportunities for strategic investors with expertise in managing alternative real estate. In search of less correlated and better risk-adjusted returns, accommodation hotels run by the right operator, with the right management expertise and keen owner oversight are a niche alternative asset offering attractive yield and potential growth upside.

For more information about our real estate and hospitality solutions, please get in touch.

- Overseas Arrivals and Departures, Australia, Australian Bureau of Statistics, www.abs.gov.au, Annual short-term visitor arrivals, year ending January 2024 compared to year ending January 2019

- Ibid., year on year increase to January 2024

- Tourism forecasts for Australia 2023 to 2028, Tourism Research Australia, www.tra.gov.au, November 2023

- Overseas Arrivals and Departures, Australia, Australian Bureau of Statistics, www.abs.gov.au, January 2024 compared to January 2019

- Tourism forecasts for Australia 2023 to 2028, Tourism Research Australia, www.tra.gov.au, November 2023

- Western Sydney International Airport will be Sydney’s first curfew free airport, able to cater for up to 10 million passengers per year on opening in 2026. www.westernsydney.com.au

- 2023 Business Travel Index Outlook, Annual Global Report and Forecast, Global Business Travel Association, www.gbta.org

- Tourism forecasts for Australia 2023 to 2028, Tourism Research Australia, www.tra.gov.au, November 2023, India economic outlook, January 2024, Deloitte Economics, www2.deloitte.com. Annual GDP growth for India is forecast at ~7% during 2023/24 and ~6.5% in 2025.

- National Visitor Survey monthly snapshot, Domestic tourism December 2023, Tourism Research Australia, www.tra.gov.au

- CommBank Household Spending Insights, Economic Insights, February 2024. The annual rate of increase in Recreation spending was 6.6% p.a. in February 2024, up from 5.5% p.a. in January 2024, www.commbankresearch.com.au

- 2023 Australian Hotel Transactions Overview, JLL Hotels & Hospitality Group, Australia, January 2024, www.jll.com.au

Important Information: This material has been prepared by MA Asset Management Ltd (ACN 142 008 535) (AFSL 327 515). The material is for general information purposes and must not be construed as investment advice. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer or invitation to purchase, sell or subscribe for in interests in any type of investment product or service. This material does not take into account your investment objectives, financial situation or particular needs. You should read and consider any relevant offer documentation applicable to any investment product or service and consider obtaining professional investment advice tailored to your specific circumstances before making any investment decision. Any investment in a fund managed by MA Financial Group is subject to the terms and conditions of the relevant fund offer document. This material and the information contained within it may not be reproduced or disclosed, in whole or in part, without the prior written consent of MA Asset Management Ltd. Any trademarks, logos, and service marks contained herein may be the registered and unregistered trademarks of their respective owners.

Nothing contained herein should be construed as granting by implication, or otherwise, any licence or right to use any trademark displayed without the written permission of the owner. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of MA Asset Management Ltd. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Additionally, this material may contain “forward-looking statements”. Actual events or results or the actual performance of MA Asset Management Ltd or an MA Asset Management Ltd financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. Certain economic, market or company information contained herein has been obtained from published sources prepared by third parties. While such sources are believed to be reliable, neither MA Asset Management Ltd, MA Financial Group or any of its respective officers or employees assumes any responsibility for the accuracy or completeness of such information. No person, including MA Asset Management Ltd and MA Financial Group, has any responsibility to update any of the information provided in this material.